COMPENSATION REPORT

1. INTRODUCTION

This Compensation Report is intended to provide an overview of the compensation structure, compensation procedure and Compensation Committee of Investis Holding SA and the compensation amounts paid to the members of the Board of Directors and Executive Board for the financial year 2023. The Compensation Report follows the requirements of the Swiss Code of Obligations and sections 5.1 and 5.2 of the Annex to the Directive on Information Relating to Corporate Governance issued by SIX Exchange Regulation. In addition, Investis Holding SA has taken into account the Swiss Code of Best Practice for Corporate Governance issued by economiesuisse. The Compensation Report regarding the financial year 2023 has been reviewed and audited by the Company’s auditors and will be submitted to the 2024 Annual General Meeting for an advisory vote. Please find the Auditors’ Report at the end of this chapter.

2. COMPENSATION COMMITTEE

According to Article 25 of the Articles of Association and the Organisational Regulations of Investis Holding SA, the Compensation Committee consists of at least two non-executive members of the Board of Directors. The members of the Compensation Committee are elected annually and individually by the Annual General Meeting for a term of office of one year ending at the close of the next Annual General Meeting following their election. At the end of their term of office, members of the Compensation Committee can be re-elected. The Chairman of the Compensation Committee is appointed by the Board of Directors. Currently, the Compensation Committee consists of Albert Baehny (Chairman) and Corine Blesi. In the opinion of the Board of Directors, both Compensation Committee members possess the required experience for this function and are familiar with the regulatory requirements and with compensation practices and developments.

The Articles of Association, containing the precise wording of the provisions mentioned above and below, and the Organisational Regulations can be found on the Investis website.

https://www.investisgroup.com/en/investors/corporate-governance

The duties and responsibilities of the Compensation Committee are set out in Article 26 of the Articles of Association and further described in detail in the Organisational Regulations of Investis Holding SA as issued by the Board of Directors. In accordance with the Organisational Regulations, the Board of Directors of Investis Holding SA has adopted separate Compensation Committee regulations which govern in detail the organisation, functions, operation and modalities of the resolutions passed by the Compensation Committee. Meetings of the Compensation Committee are convened by its chairman and are held as often as required for the fulfilment of its duties, but at least three times a year.

The main duty of the Compensation Committee is to develop the compensation principles, compensation policies and performance criteria with respect to compensation for the Board of Directors and the Executive Board of Investis Holding SA and to monitor their implementation in order to ensure fair, reasonable and competitive remuneration that is consistent with the strategic objectives of the Investis Group. The Compensation Committee further prepares decisions of the Board of Directors that relate to the compensation of the Board of Directors and the Executive Board and submits motions to the Board of Directors. In addition, the Compensation Committee assists the Board of Directors with respect to the preparation of the Compensation Report.

3. COMPENSATION PROCEDURE

The Compensation Committee annually reviews the compensation structure and the amounts of compensation paid to the members of the Board of Directors and the members of the Executive Board. It also submits motions and recommendations for compensation-related decisions and changes to the compensation structure and policies to the entire Board of Directors. The Board of Directors takes its compensation-related decisions in response to the motions and recommendations presented by the Compensation Committee. This annual review process includes an assessment of basic salaries and fringe benefits as well as performance-based short-term remuneration and stock purchase plans.

If necessary, the Compensation Committee may use the services of independent external consultants. External consultants are usually used to ensure remuneration is benchmarked and to contribute to the design of compensation plans.

Members of the Executive Board are not involved in determining their own remuneration. However, the Chief Executive Officer (CEO) is consulted about the remuneration proposed for the other members of the Executive Board.

Recommendations by the Compensation Committee about the remuneration of members of the Board of Directors must comply with internal corporate guidelines. Remuneration of members of the Board of Directors must be approved by all members of the Board of Directors; however when a vote is taken on compensation for a specific member of the Board of Directors, that member must comply with the applicable walkout rules.

3.1 Performance review process

The actual remuneration effectively paid out in a given year depends on the individual’s and on the Company’s performance. Individual performance is assessed through the formal annual review process. Company and individual performance objectives are approved at the beginning of the business year, and achievements against those objectives are assessed after year-end. The performance appraisal is the basis for the determination of the actual remuneration.

4. COMPENSATION-RELATED RULES IN THE ARTICLES OF ASSOCIATION

4.1 Principles of compensation

The Investis Group is committed to attracting, motivating and retaining the best professionals and managers to ensure the sustained success of the Company.

Pursuant to Article 19 of the Articles of Association, the members of the Board of Directors and the members of the Executive Board are entitled to remuneration commensurate with their activities. The remuneration may be paid by the Company or by another Group company provided it is covered by the total compensation amount approved by the General Meeting for the Board of Directors or Executive Board, as applicable. Reimbursement of expenses does not qualify as remuneration. The Company may reimburse members of the Board of Directors and of the Executive Board in the form of lump-sum expenses as recognised for tax purposes.

The Articles of Association, containing the precise wording of the provision mentioned above, can be found on the Investis website.

https://www.investisgroup.com/en/investors/corporate-governance

4.2 Remuneration of the Board of Directors

The members of the Board of Directors receive fixed remuneration, half of which is awarded in shares. No other remuneration or committee fees are paid except for the relevant employer social security contributions.

The preferential allocation price of the shares concerned is redefined each year and is equal to the base price minus a discount. The base price consists of the average of the official closing prices of Investis shares at the Swiss Stock Exchange (SIX) during the calendar year prior to the share award. The Board of Directors determines the amount of the discount each year at its discretion, taking into consideration the performance and results of the Investis Group during the financial year prior to the share award.

The shares are allocated on the day the Board of Directors approves the consolidated financial statements of the Investis Group. These shares are subject to a blocking period of three years. During the blocking period, the shares may not be disposed of, sold, donated or transferred in any other way (other than by a transfer by operation or application of the laws of succession). Subject to applicable securities laws restricting resale of the shares at the end of the blocking period, the member of the Board of Directors may freely dispose of the shares. During the blocking period, shares will be held for the participant in his or her account. The participant will have the right to vote in respect of his or her shares and to receive all dividends and other distributions in respect of them. In the event of a stock split, stock dividend or distribution of property other than cash affecting the shares, the shares and/or property received, will, unless the Board of Directors determines otherwise, be held in the participant’s account and be subject to the transfer restrictions set out in this rule applicable to the related shares.

In the event of the death or total disability of the participant, the blocking period of his or her shares will terminate immediately, and all of his or her shares will be delivered to him/her or his/her personal representative, as appropriate and as soon as practicable. The participant will be liable for any additional tax liability arising from the acceleration of the blocking period.

Unless otherwise determined by the Board of Directors, upon termination of the participant’s assignment the blocking period of the shares will continue in accordance with its terms. If the Board of Directors determines otherwise, the participant will be liable for any additional tax liability arising from the acceleration of the blocking period.

If a change of control occurs, any blocking period will be terminated, i.e. the participant will have the right to sell the shares that are still subject to a blocking period.

The discount may be fully taxable according to the applicable laws. The participant is responsible for reporting the receipt of any income from these shares, however made, to the appropriate tax authority.

The Board of Directors may at any time amend or terminate the plan in any respect except that no amendment or termination may adversely affect the existing rights of the participant. The participant will be given written notice of any amendment that affects him or her as soon as practicable.

The Investis Group uses treasury shares bought at market price on the open market to grant shares. This does not dilute the value of the shares of existing shareholders.

4.3 Remuneration of the Executive Board

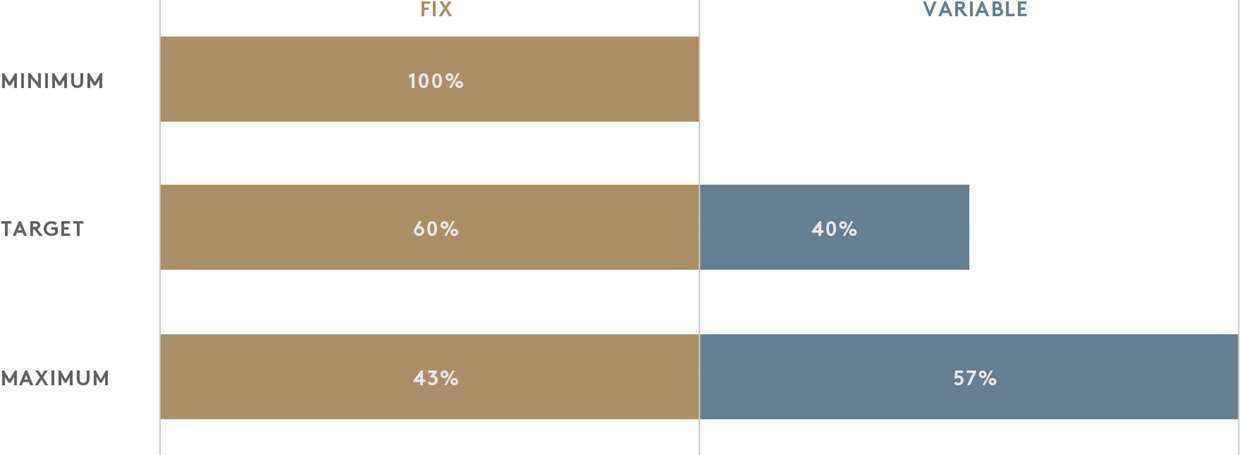

The remuneration of members of the Executive Board consists of a fixed and a variable component.

4.3.1 Executive Board fixed compensation

The fixed components are proposed by the Compensation Committee and approved by the Board of Directors. When considering changes to fixed salary components, benchmarking data and the individual’s performance during the previous year are taken into account. The fixed component fluctuates between 60% and 70% of the total compensation. The fixed compensation is entirely paid in cash.

4.3.2 Executive Board variable compensation

The variable component fluctuates between 30% and 40% of the total compensation. The amount of the variable compensation depends on qualitative and quantitative targets and parameters defined by the Compensation Committee and approved by the Board of Directors. At least 50% of this variable compensation is paid in shares, and the remainder in cash. All variable compensation payments are based on the Investis financial year, which runs from 1 January to 31 December.

The Board of Directors defines and assesses the targets and their achievement or delegates this task to the Compensation Committee. All such variable compensation payments constitute one-off remuneration and are subject to tax and social security contributions as applicable to the participants’ other recurring compensation.

The variable compensation is measured by the following components:

Each of the G/O/N/S components accounts for a quarter of the targeted variable compensation amount.

The financial targets set out below and valid for the financial year 2023 are independent of each other and are measured and evaluated separately.

4.3.2.1 Calculation of the amounts available for variable compensation payments

Component G is related to the achievement of the budgeted financial targets that the respective member of the Executive Board is responsible for. If the budgeted financial target is 100% achieved, then the component G variable compensation will be paid. If the budgeted financial target is exceeded (overachieved) or is not met (underachieved), the component G variable compensation will be increased or decreased by 3% for every 1% deviation from the budgeted financial target.

Component O is:

- –partly (2/3) related to the achievement of the budgeted financial targets that the respective member of the Executive Board is responsible for; and

- –partly (1/3) related to the achievement of the budgeted financial targets “one level up”.

If the budgeted financial target is 100% achieved, then the component O variable compensation will be paid. If the budgeted financial target is exceeded (overachieved) or is not met (underachieved), the component O variable compensation will be increased or decreased by 3% for every 1% deviation from the budgeted financial target.

Component N is related to the achievement of the financial targets budgeted at the Investis Group level, i.e., that the entire Executive Board is responsible for.

Component S is related to the achievement of the yearly or multi-year ESG targets. The Board of Directors sets every year three to five new ESG targets that the Executive Board needs to achieve in the respective year or step-by-step over a multi-year period. If a specific ESG target is not fully achieved (underachieved), the component S variable compensation will be decreased proportionally for every underachieved target. If all goals for a targeted year are fully achieved, the component S is set to 150%.

The CEO and CFO are always measured at Group level.

4.3.2.2 Cap and floor for each component

The above system is limited in both directions at 100% for each individual component, i.e. each component can range from 0% to 200%. If the actual result is overachieved by more than 33.33% above the budgeted financial target, the respective component is set to 200%. If the actual result is underachieved by more than 33.33% below the budgeted financial target, this component will be set to 0%, i. e. to zero.

Visualisation of the compensation components described above:

4.3.2.3 Financial targets

The relevant financial targets are derived from the annual budget of the Investis Group and approved by the Board of Directors.

4.3.2.4 Supplementary provisions

The criteria and formulas for calculating overall variable compensation amounts are assessed and adjusted annually by the Compensation Committee. The employee’s annual salary, including the target variable compensation achievable, represents a particular target package for each Executive Board member.

Should the principles on which the variable compensation component is based be affected by acquisitions (of consolidated companies and/or investment properties), divestitures (of consolidated companies and/or investment properties), major projects not budgeted for but approved by the Board of Directors or an increase or decrease in the employee’s responsibilities, the variable compensation calculation criteria and formulas may/will be adjusted accordingly.

Effects from the revaluation of investment properties and related deferred taxes are not included in any calculation of components O and N.

The Board of Directors determines the respective amounts of remuneration within the total remuneration amounts approved by the General Meeting and in response to proposals made by the Compensation Committee. All variable compensations are optional payments whose amount is at the full discretion of the Board of Directors.

4.3.3 Share-based compensation

The amount that a member of the Executive Board must invest in shares is set at a minimum of 50% of the individual variable compensation.

The number of shares is equal to the portion of the variable compensation that the eligible person chose to invest divided by the preferential allocation price of the shares, whereby the number of shares is rounded to the nearest whole number of shares. The residual part of the variable compensation is paid to the participant in cash.

The preferential allocation price of the shares is redefined each year and is equal to the base price minus a discount. The base price consists of the average of the official closing prices of Investis shares at the Swiss Stock Exchange (SIX) during the calendar year prior to the share award. The Board of Directors determines the amount of the discount for each year at its discretion, taking into consideration the performance and results of the Investis Group during the financial year prior to the share award.

The shares are allocated on the day the Board of Directors approves the consolidated financial statements of the Investis Group. These shares are subject to a blocking period of three years. During the blocking period, the shares may not be disposed of, sold, donated or transferred in any other way (other than by a transfer by operation or application of the laws of succession). Subject to applicable securities laws restricting resale of the shares at the end of the blocking period, the member of the Executive Board may freely dispose of the shares. During the blocking period, shares will be held for the participant in his or her account. The participant will have the right to vote in respect of his or her shares and to receive all dividends and other distributions in respect of them. In the event of a stock split, stock dividend or distribution of property other than cash affecting the shares, the shares and/or property received will, unless the Board of Directors determines otherwise, be held in the participant’s account and be subject to the transfer restrictions set out in this rule applicable to the related shares.

In the event of the death or total disability of the participant, the blocking period of his or her shares will terminate immediately, and all of his or her shares will be delivered to him/her or his/her personal representative, as appropriate and as soon as practicable. The participant will be liable for any additional tax liability arising from the acceleration of the blocking period.

Unless otherwise determined by the Board of Directors, upon termination of the participant’s employment as a result of resignation, retirement, dismissal or dismissal for cause, the blocking period of the shares will continue in accordance with its terms. If the Board of Directors determines otherwise, the participant will be liable for any additional tax liability arising from the acceleration of the blocking period.

If a change of control occurs, any blocking period will be terminated, i. e. the participant will have the right to sell the shares that are still subject to a blocking period.

The discount may be fully taxable according to the applicable laws. The participant is responsible for reporting the receipt of any income from these shares, however made, to the appropriate tax authority.

The Board of Directors may at any time amend or terminate the plan in any respect except that no amendment or termination may adversely affect the existing rights of the participant. The participant will be given written notice of any amendment that affects him or her as soon as practicable.

The Investis Group uses treasury shares bought at market price on the open market to grant shares. This does not dilute the value of the shares of existing shareholders.

4.4 Approval of total compensation by the General Meeting

According to Article 20 of the Articles of Association, the General Meeting approves annually, separately and with binding effect the proposals made by the Board of Directors regarding the maximum total compensation for the Board of Directors and the Executive Board as follows:

- –For the remuneration of the Board of Directors, the maximum total amount is approved for the period until the next Annual General Meeting;

- –For the remuneration of the Executive Board, the maximum total amount is approved for the financial year following the Annual General Meeting (approval period).

If the proposed remuneration amount for the Board of Directors or the Executive Board is rejected by the Annual General Meeting, the Board of Directors can put forward new proposals at the same General Meeting or can convene an Extraordinary General Meeting for this purpose.

The Articles of Association, containing the precise wording of the provision mentioned above, can be found on the Investis website.

https://www.investisgroup.com/en/investors/corporate-governance

4.5 Additional amount for the compensation of additional members of the Executive Board

For Investis Holding SA, the additional amount is governed by Article 21 of the Articles of Association. Pursuant to this provision, an additional amount of not more than 33% of the last total compensation amount approved for the compensation of the members of the Executive Board is available per year for each new member of the Executive Board who is appointed after the annual total compensation has been approved by the General Meeting, if the aggregate amount approved for the respective approval period proves insufficient.

The Articles of Association, containing the precise wording of the provision mentioned above, can be found on the Investis website.

https://www.investisgroup.com/en/investors/corporate-governance

4.6 Loans and credits, post-retirement benefits outside the occupational pension scheme

Pursuant to Article 22 of the Articles of Association, loans and credits to members of the Board of Directors or Executive Board may only be granted at market conditions. Furthermore, the total amount of any loans and credits granted directly or indirectly to members of the Board of Directors or Executive Board may not exceed CHF 50 million.

The Articles of Association of Investis Holding SA do not allow the payment of post-retirement benefits outside the occupational pension scheme to members of the Board of Directors or Executive Board.

The Articles of Association, containing the precise wording of the provision mentioned above, can be found on the Investis website.

https://www.investisgroup.com/en/investors/corporate-governance

4.7 Termination clauses applicable to members of the Executive Board

The employment contracts of the members of the Executive Board provide for a twelve-month notice period. There is no entitlement to any severance payments.

In the event of a change in corporate control, no additional compensation or benefits will be paid to members of the Executive Board.

5. COMPENSATION, LOANS AND CREDITS TO THE BOARD OF DIRECTORS AND THE EXECUTIVE BOARD (Audited information)

The following paragraphs provide information on the compensation granted to the members of the Board of Directors and Executive Board for the financial year 2023, as well as information about loans and credits granted to the members of the Board of Directors and Executive Board.

5.1 Compensation of the Board of Directors and the Executive Board

5.1.1 Compensation of the Board of Directors

(Non-executive)

For the approval period up to the 2024 Annual General Meeting, maximum total compensation of CHF 0.7 million was approved by the General Meeting of 3 May 2023 for the compensation of the Board of Directors.

The following table sets out the aggregate compensation granted to the Board of Directors for 2023 and 2022, as well as the compensation granted to the individual members of the Board of Directors.

Compensation of the Board of Directors in detail for 2023 and 2022:

Audited information5.1.2 Compensation of the Executive Board

(Including the executive member of the Board of Directors)

The following table sets out the compensation granted to the Executive Board for the financial years 2023 and 2022 as well as the compensation granted to the individual member of the Executive Board who received the highest remuneration in 2023 and in 2022. For 2023, the shareholders' meeting has approved maximum total compensation for the members of the Executive Board (three members) of CHF 3.7 million. As there has been an additional member in 2023, article 19 of the Articles of association has been used to amend the initially approved compensation by 33% up to CHF 4.9 million for four members.

Audited informationNo remuneration was paid in 2023 or 2022 to former members of the Executive Board (either directly or indirectly) or to any persons affiliated to current or former members of the Executive Board.

The Articles of Association, containing the precise wording of the provision mentioned above, can be found on the Investis website.

https://www.investisgroup.com/en/investors/corporate-governance

5.2 Loans and credits to the Board of Directors and Executive Board

5.2.1 Loans and credits to the Board of Directors

No loans or credits have been granted to any current or former members of the Board of Directors or to any persons affiliated to current or former members of the Board of Directors.

As at 31 December 2023, the Group had no outstanding loans to any related party.

5.2.2 Loans and credits to the members of the Executive Board

No loans or credits have been granted to any current or former members of the Executive Board or to persons affiliated to current or former members of the Executive Board.

As at 31 December 2023, the Group had no outstanding loans to any related party.

6. SHARE OWNERSHIP (AUDITED INFORMATION)

Members of the Board of Directors

(Non-executive)

As at 31 December 2023, the non-executive members of the Board of Directors (including their related parties) held the following Investis shares.

Audited informationMembers of the Executive Board

(Including the executive member of the Board of Directors)

As at 31 December 2023, the executive member of the Board of Directors and the members of the Executive Board (including their related parties) held the following Investis shares.

Audited information